Am I Able To assign the identical profit or deduction to a quantity of staff at once? Once a payroll merchandise is created, you possibly can assign it to a number of employees via the Employee Heart or during the payroll setup process to save heaps of time and guarantee consistency across your staff. We manage payroll tax payments and filings for you—guaranteed to be on time and correct. There’s a growing pattern of businesses hiring fewer employees, sometimes only one. If you’re questioning how to set up payroll for one employee, we’re joyful to report that there’s no real distinction in the procedure.

- We outline QuickBooks Online Payroll as a cloud-based different related to the QuickBooks Desktop Payroll in case you’re in search of it.

- Intuit Enterprise Suite is newer and may face stability points, such as occasional crashes or slow performance.

- A proud mother and Big Apple University graduate, Julie balances her skilled pursuits with weekends spent with her family or browsing the iconic waves of Oahu’s North Shore.

Quickbooks Time Elite

And now that these clients are paying for the extra costly program, Intuit is tacking on payroll costs. It is fascinating to me that Intuit is abandoning their unique consumer base by pricing themselves out of the market for small businesses. Guess what, Intuit, the massive businesses are too massive for you, so stop thinking you can charge as a lot as the large applications. The rate of will increase to each software program pricing and payroll pricing is extraordinary.

The vendors that appear on this listing were chosen by material experts on the premise of product quality, wide usage and availability, and optimistic popularity. By offering suggestions on how we can improve, you can earn present cards and get early access to new options. Gusto is an all-in-one people platform that simplifies payroll many human assets duties. In this publish, we’ll break down every little thing you should learn about QuickBooks Payroll, how much it costs, and what other options are available to companies on the lookout for extra affordable options. You must renew every year to continue utilizing the software and receiving updates. You get a clear view of the entire gross sales pipeline while saving hours of handbook work.

The software provides e-payment and e-filing capabilities which lets you speed the entire course of even if the submit ion tax funds and tax forms are accomplished by your self. In case you filed your taxes on the proper interval of time, with the correct data, and with sufficient cash in your account to cowl them. QuickBooks will take care of all of the tax funds and tax type submissions which incorporates the stories of the top yr. It is very important for small enterprise homeowners who need to outsource payroll tax administration.

Our experts suggest Xero’s accounting software program for small businesses. Nonetheless, when you operate a bigger enterprise (with a bigger budget), and you’re looking for locally-installed accounting software with built-in payroll, QuickBooks Enterprise could additionally be a great fit. With over 200 customizable reviews, the Gold plan helps you get the insights you need to run your corporation your means.

Intuit Enterprise Suite Vs Quickbooks On-line: Comparison Desk

Businesses utilizing automated payroll methods report a 31% discount in errors in comparison with these with manual processes. That’s a large difference when you’re dealing with hundreds or 1000’s of paychecks. Even scarier, over half 53% of corporations have incurred a payroll penalty in the final five years as a result of non-compliance.

Quickbooks Desktop is particularly helpful for businesses that prioritize data safety and management entry with out relying on the web. Many instances freelancers and small businesses don’t want all of the bells and whistles of a sophisticated software answer, such as QuickBooks Enterprise. That is where easy-to-use accounting software program, corresponding to FreshBooks, come into play. FreshBooks covers all of the fundamentals with invoicing, time tracking, expense management, project management quickbooks enterprise payroll and monetary reporting options. It also integrates with PayPal and Stripe to make cost processing simple.

The payroll system debits the account when recording the expense, and the precise financial institution transaction the withdrawal of the online https://www.quickbooks-payroll.org/ pay clears the account. If the balance of this account returns to zero after reconciliation, your journal entry is accurately posted. Before you begin signing contracts, sit down along with your Controller or CFO and reply these tough questions.

If you’d like to study extra about QuickBooks Enterprise Desktop internet hosting and the way it differs from QBO and IES products, connect with Ace Cloud Internet Hosting today or start your 7-day free trial. Change to cloud-hosted QuickBooks Enterprise with Ace Cloud Internet Hosting and luxuriate in safe distant entry, scalability, and 24×7 assist. If you’ve QuickBooks On-line or QuickBooks Desktop, you’ll be able to add payroll anytime. QuickBooks Payroll is included with QuickBooks Enterprise Gold, Platinum, and Diamond plans. We worth your privacy and will use your data only to speak and share related content, products, and services.

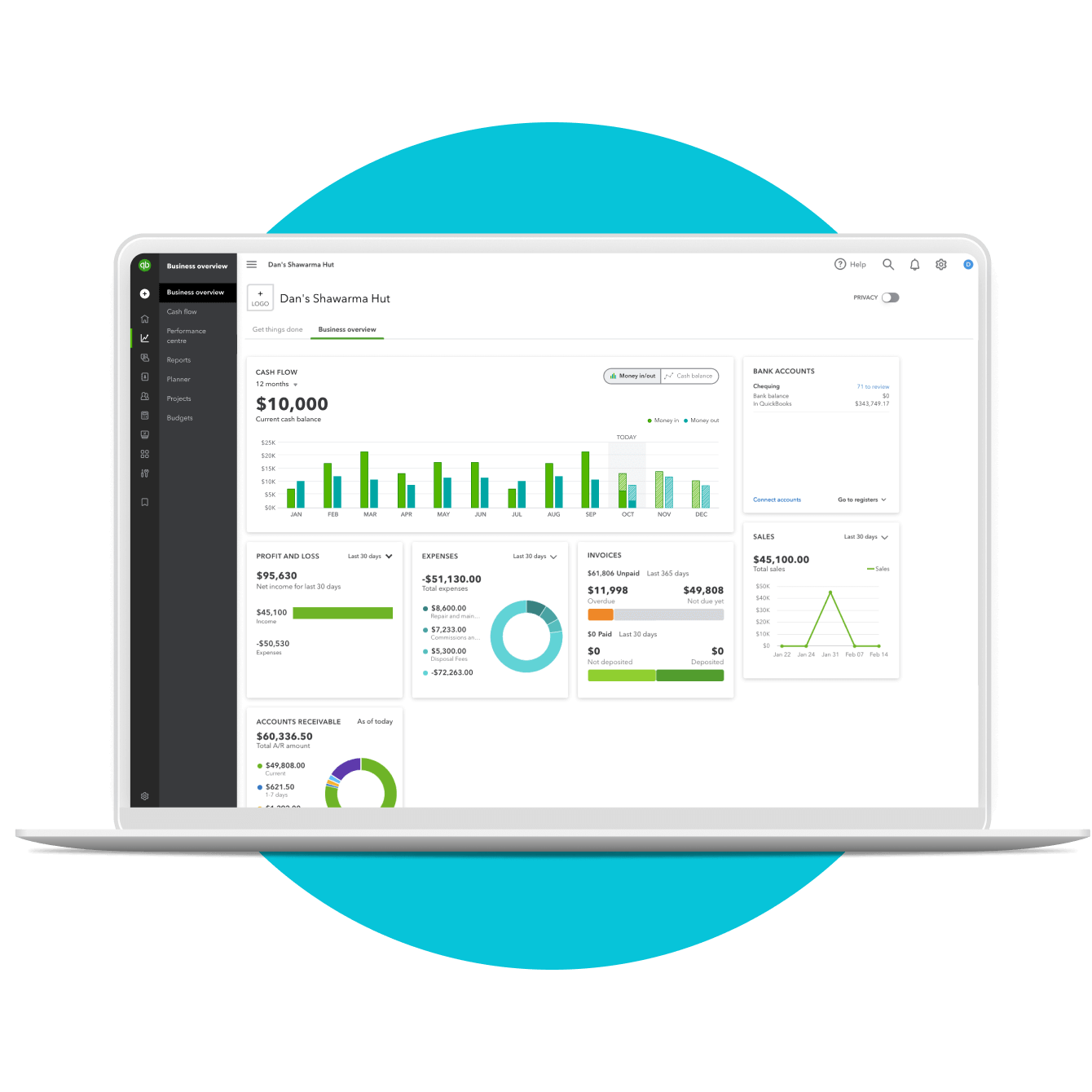

QuickBooks Assisted Payroll contains providers that submit payroll taxes. This setup is right for each SMBs and huge enterprises, providing all the options of the desktop version with the flexibleness of the cloud. Intuit Enterprise Suite is finest fitted to massive organizations that want an all-in-one enterprise solution. At the identical time, QuickBooks Online is right for small to mid-sized companies in search of a simple, browser-based accounting answer. Intuit Enterprise Suite is an AI-powered business platform that mixes your financial, payroll, HR, advertising, and money circulate tools in one place. Devoted success managers assist you to connect your knowledge and tools to streamline operations, improve productiveness, and make smarter choices with built-in enterprise insights.